Warren Buffett's trade teach us How to earn money after the Global Financial Crisis

Market crash is the biggest opportunity to make money!

In order to find ways to make a big profit by buying and selling after the collapse, this time I summarized Warren Buffett's actions at the time of stock market crash.

As a result, I found that it is effective to purchase financial stocks in the US stock (the price increase after the crash is 240 to 780%!). In addition, if Buffett does not have the funds to purchase financial stocks, it also found out that they are preparing funds by selling other stocks.

So, if you prepare cash, you can make a big profit at the time of crash.

"Prepare cash by crash and buy stock at crash" · · · Actually, it is , "privilege of individual investor".

Because institutional investors understand this effectiveness, it is impossible to prepare a lot of cash (assuming a crash and waiting for cash in cash, it is because funds deposited from investors It is the same as playing it).

So I recommend you to prepare cash by all means in preparation for a crash.

As for Buffett, the cash ratio is high now.

table of contents

- Introduction

- Dotcom bubble collapse and the financial crisis of 2007–2008, What then did Buffett do

- U.S stock market crash and Buffett buying timing

- Company in which Buffett has traded shares

- Reasons to purchase financial stocks

- Appendix:Buffett's trading cycle is about 3 years!

Introduction

As of 2018, from the cycle of business cycle and numerous indicators, there is a voice saying that stocks may crash soon.

I also feel that way.

It is the same as the earthquake, you can not predict stock crash. However, it is possible to make a profit by acting well after a crash.

So, in order to shift the mind from prediction to countermeasures and to make a big profit in the stock, I tried summarizing Buffett 's action after the stock market crash.

Dotcom bubble collapse and the financial crisis of 2007–2008, What then did Buffett do

Next, let's look at buying timing and shares of Buffett after the crash.

U.S stock market crash and Buffett buying timing

Let's see the trend in the cash ratio of US stock (SP 500) from the end of 1997 to August 2018 and Berkshire Hathaway (Buffett's investment company).

* Based on the balance sheet of the Berkshire Hathaway annual report, the cash ratio compiled the total value of Cash and U.S. T (US Treasury bill) into cash. I calculate the cash ratio by dividing cash by the valuation of the shares held by Berkshire Hathaway.

Well, looking at this figure you will see the following.

· The Dotcom Bubble collapsed in 2000. Shortly before that, the cash holding rate declined (11 ⇒ 3%) in 1999, so a large tender purchase (a bit incorrect timing?).

· From 2002 to 2007 it is refraining from buying. Clearly the cash holding rate is high.

· The financial crisis of 2007–2008 is occurred. Mass purchase in 2008.

In other words, Buffett increases the cash holding rate during booming, and actively buys shares at the time of stock price crash.

Next, I will look at Buffett's performance of asset management.

Blue plot is the trend of the appraisal value of Berkshire Hathaway possessed shares.

The performance from the end of 1997 to the end of 2017 is tremendously high, 12.5 times the valuation of the holding stock! (About 13.5% in terms of annual interest).

By comparison, you can see that it overwhelmingly outnotes SP 500 (SP 500 is 3 times at most.)

Company in which Buffett has traded shares

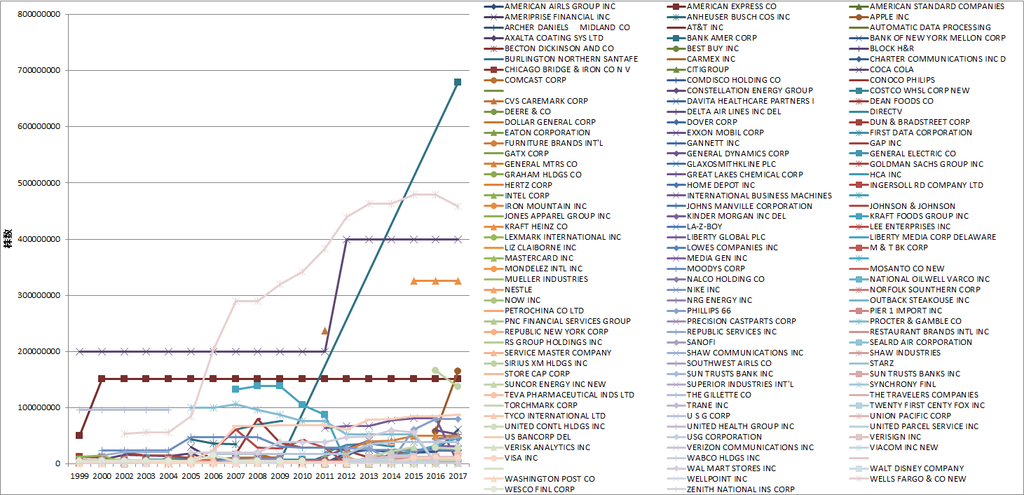

Let's see the stocks buffet buy and sell. There are 136 stocks held even temporarily between the end of 1999 and the end of 2017 where the data remains. It is difficult to discuss with this, so I would like to narrow down the stocks sold after the crash to more than $ 500 million.

Please note that because I calculated the data from the number of shares held at the end of each fiscal year, I can not grasp the stock traded within the fiscal year.

Immediately before Dotcom Bubble

1999 · · · There is no data of 1998, the stock that he bought is unknown.

2000 · · purchased 555 billion yen for Amex (American Express, credit card company). There is no sale of $ 500 million or more.

| Buy | American Express | 5552M$ |

| Sell | none | - |

Immediately after the Lehman shock

2008

· Concoco Phillips (oil company) purchased 3232 M$.

· Purchased 500 M$ worth of preferred stock of Goldman Sachs (investment bank) (10% dividend!).

· He sold a large amount of Well-known stocks owned by Buffettt ,such as Anheuser bush (famous beer company in Budweiser), Johnson & Johnson, P & G (total 4443 M$)

· Burlington Northern Santa Fe purchase 771 M$.

(Berkshire bought it in 2009. Preparation for that)

| Buy | Burlington Northern Santa Fe | 771M$ |

| Concoco Phillips | 3232M$ | |

| Goldman Sachs(preferred stock) | 5000M$ | |

| Sell | Anheuser bush | 1871M$ |

| Johnson & Johnson | 1983M$ | |

| P&G | 589M$ |

2009

· Purchased Wal-Mart for 1021M$. Purchased Wells Fargo (bank) 805M$.

· He sold a large amount of ConocoPhillips just bought last year (¥ 3154M$). In addition, Buffett himself said that the purchase of ConocoPhillips had failed at a later date.

· As last year, he sold P & G (534M$).

· Burlington Northern Santa Fe purchase railway for 659M$

| Buy | Burlington Northern Santa Fe | 659M$ |

| Wal-Mart | 1021M$ | |

| Wells Fargo | 805M$ | |

| Sell | ConocoPhillips | 3154M$ |

| P&G | 534M$ |

What do you think? In a nutshell, Buffett's characteristic of buying and selling after two stock market crash is saying "He is purchasing large quantities of financial stocks."

· Purchase financial stock after Dotcom Bubble.

· After financial crisis of 2007–2008, purchase Goldman Sachs (Financial Stocks) and Conoco Phillips (Oil Stocks) until they sold stocks that Buffett prefers.

· If he acknowledge that the purchase of ConocoPhillips is a mistake, he sold it in 2009 and purchase Wells Fargo (Bank).

Ads by Google

Reasons to purchase financial stocks

So, why buy financial stocks? I will examine it.

The answer can be understood by looking at the trend of the stock price.

The figure below shows the trend of the stock price of Buffett buying and selling after the Dotcom Bubble and after the financial crisis of 2007–2008.

* 1 Since ConocoPhillips buying and selling is a mistake(he admitted it), I omitted.

* 2 Anheuser Bush is only for reference as it was only possible to obtain stock price data after the 2008 acquisition.

* 3 The stock price at the end of 1997 is set at 1.0.

By the way, looking at financial stocks (red group) and not financial stocks (blue group), it is intuitive to understand that "after the financial crisis of 2007–2008, stock prices of financial stocks plummeted, I think.

In addition, you can clearly figure out if you extract numbers in the table. Financial stocks fell by 63 to 81% at the time of the financial crisis of 2007–2008 and by 240 to 781% after the crisis.

| Stocks of the financial industry | Stock of consumer goods | |

|

Dotcom Bubble Declining rate |

29~54% | 33~49% |

| After Dotcom Bubble Rising rate | 91~276% | 86~166% |

| the financial crisis of 2007–2008 Declining rate | 63~81% | 29~36% |

| After the financial crisis of 2007–2008 Rising rate | 240~781% | 96~178% |

Meanwhile, except for financial stocks, In the financial crisis of 2007–2008 fell only by 29 - 36%, and even after the crisis, it increased by 96 - 178%.

Despite this indication at the time of Dotcom Bubble, the difference between financial and non-financial stocks is small (probably because it was not a fall in stock prices from financial products).

I will also include more detailed table data.

| Amex | GS | Wells.F | P&G | J&J | |

|

Dotcom Bubble Declining rate |

54% | 49% | 29% | 49% | 33% |

| After Dotcom Bubble Rising rate | 169% | 276% | 91% | 166% | 86% |

| The financial crisis of Declining rate | 81% | 68% | 63% | 36% | 29% |

| After The financial crisis Rising rate | 781% | 240% | 444% | 96% | 178% |

Okay ... You understand already.

Buffett is familiar with the fact that "the falling amount of financial stocks is large at the time of the crash and the recovery width thereafter is large", "the falling width of the non-financial stock is small and the recovery width after that is small"

(1)Increase cash before market crash,

(2)After the market collapses, he buys financial stocks,

(3)When cash becomes insufficient, he sells non-financial stocks, buy financial stocks,

He is profiting from borrowing in the subsequent market recovery.

Indeed, it is reasonable behavior.

Whether or not it will be able to continue in the future, however, is not it that it is a clever investment method to buy US financial stocks when the US stock slumps?

Appendix:Buffett's trading cycle is about 3 years!

Speaking of Buffett, the phrase "My favorite holding period is eternity" is famous, but in fact it seems that there are few promising stocks that can be held forever.

The following is the result of investigating 136 stocks held for 18 years from the end of 1999 to the end of 2017.

18 years Always held: 4 companies (Amex, Coca-Cola, M & T Bank, torch mark)

Buy at the end of 1999 and sell all shares by the end of 2017: 83 companies

It began holding before the end of 1999, or it is held at the end of 2017. Holding period can not be calculated: 49 companies

As mentioned above, only 4 companies have been held for a long time.

The classification of the number of years of ownership of 83 companies that bought after the end of 1999 and sold all shares by the end of 2017 is as follows.

63.9% sell all shares in 1 to 3 years (53 companies).

What ... only 3.6% of the stocks held for 10 years or more. Does that mean "very few stocks worth holding long?"

In addition, the average holding period of these 83 companies was only 3.2 years ... Short!

So it turned out that buying and selling Buffett was actually quite frequent, unlike the image.

After all it is important to try it yourself. The ideal is the eternity holding period, but sells stocks that we judge are not profitable · · · · · · · · It seems that I could understand "Why Buffett greatly exceeds the market average" in this survey.

Well then, here is the end.Were you satisfied?

Lastly, I indicate the source of data used this time.

The original data of this survey can be DL from the US Securities and Exchange Commission (SEC).It is pretty tough to summarize.

* US institutional investment company has an obligation to disclose the number of shares held quarterly to SEC. A file called Form 13F is the report, and anyone can check this report from the link below.

May the Fortune be with You!

Written by master_k /17/02/2019

●See also

World Economic Outlook shows 2019 - 2020 World economy maintains moderate growth!

●Go to Sitemap(Sorry, Japanese only)